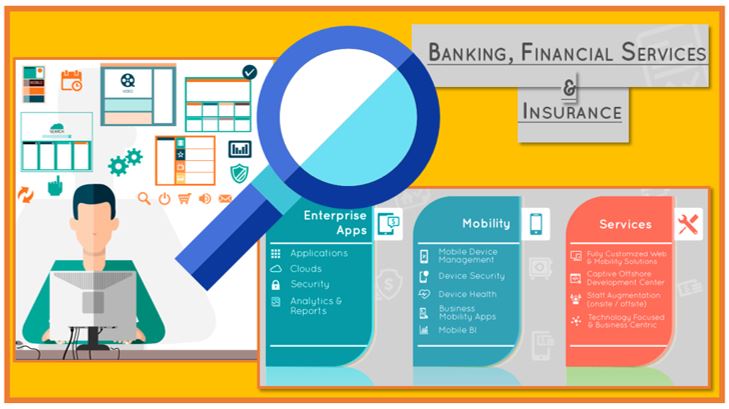

Automation touches all contemporary industries, making the dependency on software complete. In the quest to deliver error-free systems, enterprises from all domains integrate appropriate test management practices with their enterprise solutions enabled by multiple devices and multiple technologies.

With the rising expectations related to accuracy and speed of delivery of systems, a logical balance between manual & automated software testing services is inevitable for the BFSI – Banking, Financial Services & Insurance as well.

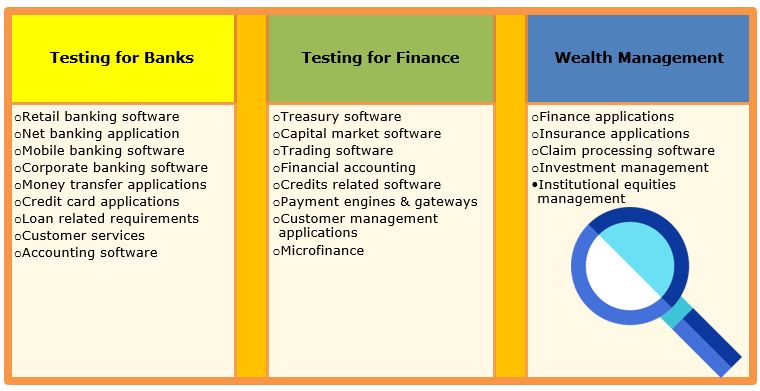

BFSI Services to be Tested

The services offered by the BFSI are varied and niche, making strategizing tests complex and an intricate process.

- Retail Banking

- Investing Banking

- Core Banking

- Corporate Banking

- Forex Management & Trading

- Credit Cards & Debit Cards

- Risk & Compliance

- Wealth Management

Specialized testing services for the BFSI offer a comprehensive approach to testing various pieces of software put together by this industry.

Testing Services for the BFSI

The Need to Automate Testing for the BFSI

Automated testing services normally drive performance testing scenarios to deliver thoroughly tested systems at a quicker pace with better precision. Agile methodologies of software development suit the ever-evolving BFSI sector much better and is a logical way to keep the compliances & regulations in place, making automated testing procedures better accepted in these scenarios.

Automating the testing services also means allowing the testers to focus on tests such as usability testing, penetration testing, and also exploratory testing by shifting repetitive tests away.

Improved User Experiences

Error-free software ensures better user experiences and customer retention. Automated testing strategized to be repetitive keeps a constant check on the system reducing the chances of any nuisances.

Reduced Lead times

With competition on the rise to keep offering accessibility from various devices, BFSI needs to constantly revise the software offered to keep in sync with the changes in operating systems as well as to accommodate new devices coming in. Automated testing speeds up the testing process, reducing the lead times to keep releasing newer versions of the software periodically.

Delivering Fool-Proof Systems

Post-production defects are efficiently averted by going full force with automated testing for BFSI. It goes without saying that manual testing retains its importance in areas requiring human judgments like functional testing, but automated testing identifies errors in the early phases of development cycles to progress towards fool-proof systems.

Enforce Regulations & Compliances

Regulatory requirements & compliances are nothing short of a nightmare when revised. A software offering the flexibility of accommodating these changes needs automated testing in place to keep a check on these changes right from the time the new code is being written.

Overcoming the Challenges of Automation Testing – Correcting Methodologies

The existing BFSI institutions have bigger challenges in terms of introducing new software or amending the older systems with appropriate testing. Competition is tough when it comes to newer enterprises who start with contemporary software, avoiding the need to keep legacy systems integrated.

Avoiding Adhoc Planning for Automated Testing

Financial institutions integrate automated testing without a long-term plan. This impacts the usefulness of automated testing services and its success. Mostly this problem arises because of a lack of maturity to understand how critical testing turns out to be.

Not Expecting Cost Cuts from Automated Testing

Automated testing enhances the testing process and is not intended to cut corners. A prevailing misconception this, arises from the fact that the BFSI expects a reduction in test resources and finally ends up being critical of the whole process, overlooking the benefits completely.

Not Integrating Automated Testing as a Continuous Process

When automated testing is implemented as a one-off exercise, it stops serving the purpose. Automated test processes integrated into the workflows, step in at every juncture to ensure that the software remains error-free.

A fragmented approach to implementation.

When not planned with a long-term vision, the testing services become fragmented between various service providers and third-party vendors. When not implemented with caution using services from multiple sources can lead to duplicate efforts, increase in costs, and inefficient testing.

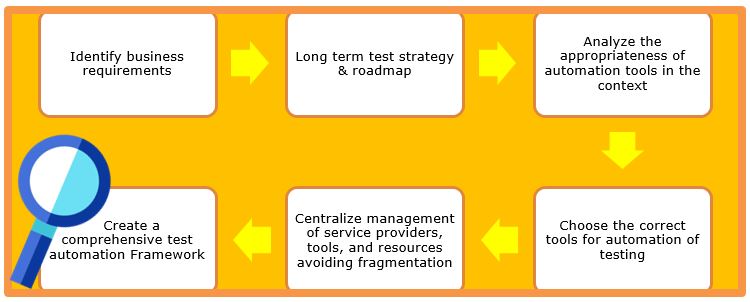

Test Automation Best Practices & Steps

Test automation when integrated into the business workflows of the BFSI, automatically becomes an ongoing process and takes the enterprise through sure steps to offering better user experiences to all; customers and employees.

Ideal Steps for Testing Services for the BFSI

In a Nutshell

Various trending technologies change the way enterprises work. Disruptive technologies like Cloud Computing, Open Software, Big Data, Business Intelligence, and IoT lead to multichannel approaches and make various services accessible with ease.

Banking, Financial Services, and Insurance base companies, or the BFSI as they are popularly called need innovative measures to sustain in a world being transformed by innovations like peer-to-peer models, crowdfunding, and contactless payments.

Fintech; the latest jargon for the IT companies empowers the BFSI with contemporary technology to offer engaging and satisfying user experiences giving utmost importance to automated testing services for the safety & security of sensitive data, auditory requirements, compliances, and governance policies for this niche industry.

Request A FREE POC To Test Drive our Services